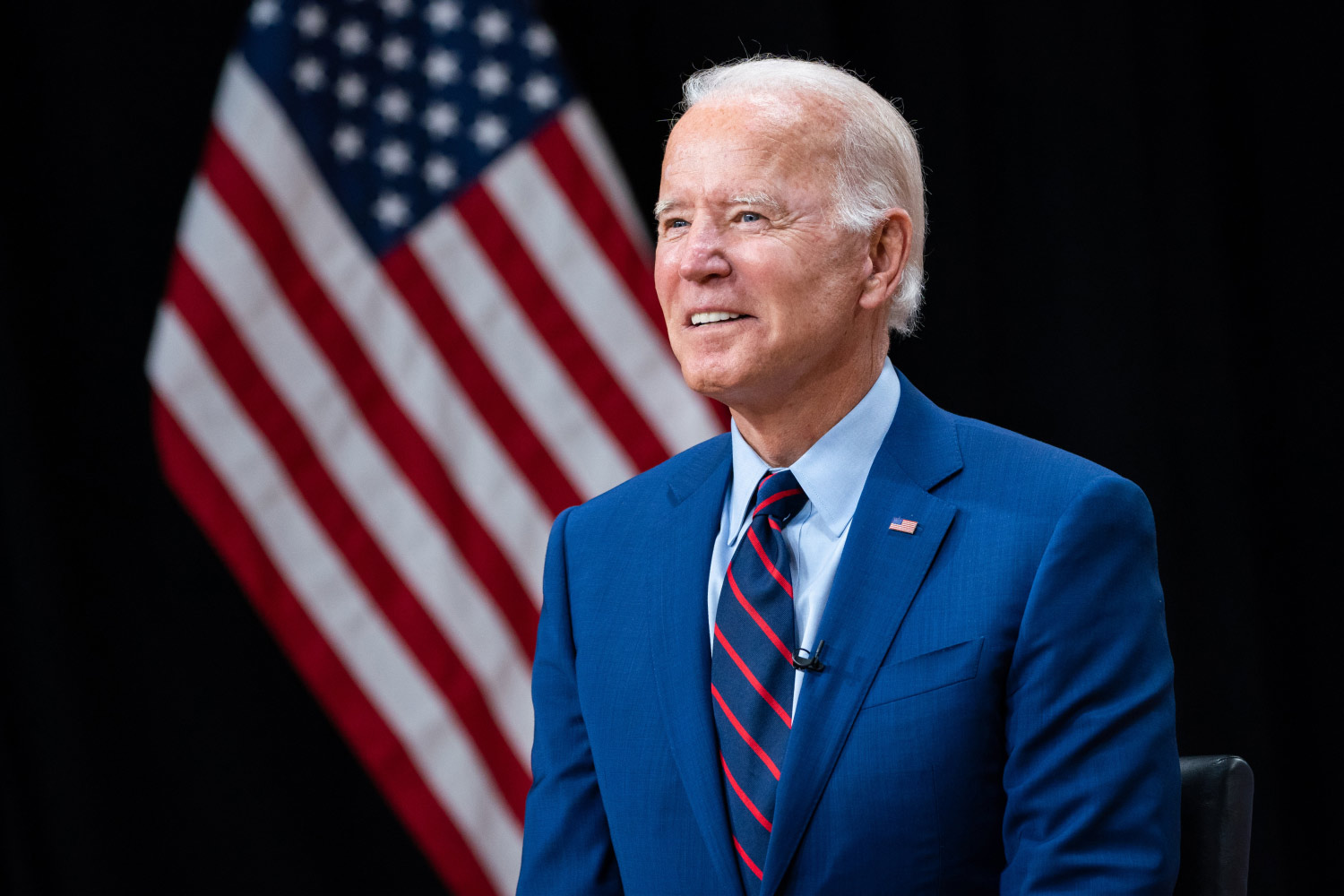

As a succession of failures prompted concerns about the stability of the financial system, the US will do “everything is needed” to support banks, according to President Joe Biden.

His remarks followed the US guaranteeing all deposits at the recently bankrupt Silicon Valley Bank and Signature Bank.

Because SVB fell as a result of an influx of withdrawals, the US is attempting to restrict customers from moving money out of banks.

People could “relax knowing that our banking system is protected,” according to Mr. Biden.

Beginning on Monday, individuals and organisations with funds deposited with SVB will have access to all of their cash, he said.

The decision, which expands protection beyond the $250,000 (£205,000) in deposits generally covered by the government, will not result in any losses for taxpayers. Instead, the expense will be covered by fees regulators charge banks.

Early on Monday, Mr. Biden addressed the nation as worries about a bigger financial crisis were being raised by the bankruptcies of SVB, the 16th largest bank in the nation, and Signature.

“And let me reassure you that this is not where we will end. Whatever is required, we’ll do.”

Biden says US banking system is safe

Regulators shut down SVB, which specialised in lending to technology startups, on Friday after seizing its assets. Since the beginning of the financial crisis in 2008, it was the biggest failure of a US bank.

It happened after SVB had to raise cash quickly to cover a loss from the sale of assets that were negatively impacted by increasing interest rates. Customers rushed to withdraw money as soon as they heard about the problems, creating a cash shortage.

Authorities also announced on Sunday that they had taken over Signature Bank of New York, which had a large number of cryptocurrency-related clients and was thought to be the organisation most susceptible to another bank run after SVB.

There is concern that the collapses, which followed the demise of Silvergate Bank last week, may be an indication of problems at other businesses.

Early trading on Monday saw the US financial markets trading approximately flat.

Nevertheless there was pressure on many banks’ shares. When trading was stopped on Monday, shares of San Francisco-based First Republic Bank fell by over 70% as investors sold off their holdings out of concern that the bank may be next.

Regulators introduced a new method for giving banks access to emergency funds as part of their efforts to rebuild trust, making it simpler for banks to borrow from it in a crisis.

Also Read: NY Regulators Seize Control of Signature Bank, Depositors Assured by Federal Bailout

In other news, HSBC announced that it would purchase SVB’s UK division for £1, and Canadian authorities temporarily seized the assets of SVB’s Canadian business.

The US government “moved vigorously to prevent a contagion emerging,” according to Capital Economics’ head economist for North America, Paul Ashworth.

“In the digital age, anything may happen in the blink of an eye, so rationally, this ought to be enough to prevent any contagion from spreading and bringing down further banks. However, fear has always been a bigger factor in spreading, therefore we should emphasise that there is no assurance that this would be effective “Added he.

Crypto News: Bitcoin Beating Warren Buffett’s Crypto Bet on 2023

The measures also reopened discussions that had raged since the 2008 financial crisis over how much the government ought to do to protect and regulate banks.

Mr. Biden emphasised the need for stricter regulation and warned that bank executives and investors would not be exempt.

“They intentionally took a risk, and as a result, his adjusters are out of pocket. This is how capitalism functions “said he.

Even nonetheless, probable 2024 presidential candidate Tim Scott, a Republican, termed the rescue “difficult.”

Creating a culture of government involvement won’t prevent future institutions from looking to it to step in when they take unwarranted risks, he claimed.

SVB began as a California bank in 1983 and has since grown quickly as the IT industry has flourished. It was the banking partner for over half of the US venture-backed technology and healthcare companies that went public last year, making it a major lender for early-stage startups in the sector.

Silicon Valley bank

The company faced difficulty last year as more of its clients drew from their deposits and it became more challenging to raise additional funds through private fundraising or share sales due to increased interest rates.

Withdrawals increased as a result of the revelation, which also increased concerns that other banks with significant amounts of money invested in bonds could suffer significant losses.

In an effort to contain growing prices, central banks around the world, particularly the US Federal Reserve and Bank of England, have dramatically increased interest rates.

These actions have decreased the demand for bonds with lower yields, which causes issues for owners like SVB in the event that a sale is required.

Also Read: How Cryptocurrency helps me to get financially strong this year